In the bookkeeping and accounting world, the complicated processes included in handling financial transactions often need accuracy and attention to detail. Even with the best moves, errors can arise and trigger the need to void checks in QuickBooks. Comprehending what it means to unvoid a check and the actual steps included in this process is important to uphold the precise financial records and make sure smooth operation in QuickBooks.

In this in-depth tutorial will cover the importance of unvoiding a check in QuickBooks, as well as common situations that require it. It also includes step-by-step instructions for unvoiding checks in QuickBooks Desktop and QuickBooks Online. Not to mention, we will also talk about the crucial tips to avoid the need to unvoid checks in the coming days, enabling you to handle potential drawbacks with accuracy and confidence.

Whether you are a fresher navigating the complexities of financial management or an experienced QuickBooks user looking for a refresher on unvoiding checks, this article is intended to offer useful insights and valuable advice to simplify your accounting procedures. Come, learn how to unvoid checks in QuickBooks and gain the skills and information you need to handle voided transactions and preserve the accuracy of your financial records.

What is meant by Unvoid a check in QuickBooks?

The process of reversing a previously canceled check's void status and bringing it back into an active position inside QuickBooks is known as Unvoiding a check.

This QuickBooks feature has a big impact on financial record-keeping and accounting accuracy. A cheque that is unvoided reactivates the initial transaction, maintaining the accuracy and consistency of the financial data. In general, voiding checks makes it possible to properly reconcile and monitor accounts, offering a smooth audit trail for transactions.

In order to streamline this process and help businesses manage their check transactions and keep correct financial records, QuickBooks is essential.

Why it is important to unvoid a check in QuickBooks?

The need to unvoid a check in QuickBooks can occur in a number of ways, most frequently as a result of the need to correct mistakes, update data, or attend to certain financial management obligations.

For example, a known situation for unvoiding a check will be when a wrong payee was recorded initially, or when you had to adjust the check amount because of a billing adjustment. In such a situation, QuickBooks plays a vital role in allowing users to reverse the particular voided check and make the required rectifications easily.

This particular ability not only increases precision in the financial records but also simplifies the total management of the finances of a company, making sure the errors are corrected promptly, and keeping the financial process intact.

What are the common scenarios when a check should be unvoided?

The obvious situations in which a check might be voided in QuickBooks include fixing payroll mistakes, updating vendor data, and modifying accounting records to accurately reflect financial transactions, among other things.

- Unvoiding a check enables the correction of overpayments, underpayments, or other discrepancies in employee compensation in cases of payroll problems.

- Unvoiding a check allows changed payment information to be easily incorporated when changing vendor information, resulting in accurate and transparent financial records.

In order to maintain the integrity and correctness of financial management inside QuickBooks and streamline the payroll and financial management procedures overall, accounting records must be adjusted to display precise financial transactions. This requires unvoiding checks.

How to Undo a Voided Transaction by Re-entering the Transaction

- Firstly launch your QuickBooks Desktop.

- Then you need to search for the transactions and open it.

- Next, go to the bottom bar and click on the More tab.

- After that click on the Audit history option.

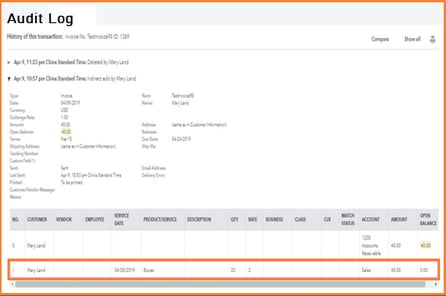

- Now go to the top right side of the screen and click on the Show All button. Here are all the edits and the original details for the transaction.

- As soon as you get the transaction information you can make use of the back button from the browser and you will be directed to the screen where you can re-enter all the information.

How To Unvoid A Paycheck In QuickBooks

- Open QuickBooks: First of all Open your QuickBooks software.

- Head to Accountants & Taxes Option: Then click on the Reports tab and select the Accountants and Taxes option from the context menu.

- Copy The Transaction Amount: Next, navigate to the voided transactions and you need to copy the transaction amount.

- Select Chart of Accounts Option: Further, click on the Lists menu and select the Chart of Accounts option.

- Open The Account Register: Now double-click on the accountant tab to open the account register that consists of the voided transaction.

- Click on The Register: Then you need to click on the register so that you can see the voided transactions.

- Enter The Amount: Next, enter or paste the amount of the original transaction.

- At Last Save Button: Once you have done this click on the Save button.

- Issues Faced By Users: Some people encounter issues like how to unvoid a cleared check that was voided by mistake.

- Or Can the Voided Check be Reused: So to solve these issues, you can always take the help of our SMB professionals.

For more information, you can contact our SMB QuickBooks Technical Support team. Our services are extensively acknowledged across the world. We have a different SMB QuickBooks Support department that will focus on your issues and give you the optimal solution.

How to Unvoid a Check in QuickBooks Desktop?

If you are also looking to unvoiding a check then it is not possible. But there is one thing that you can do Audit log. This feature is used to enter your details again correctly.

To use the Audit log feature the steps are as follows:-

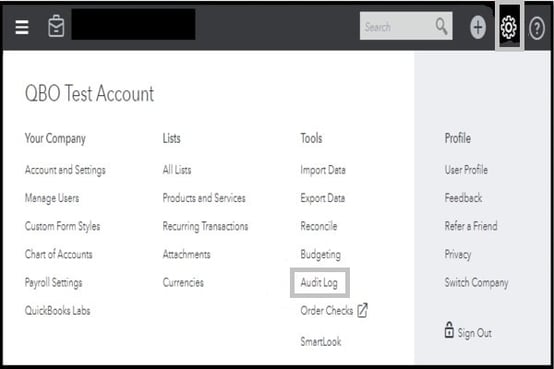

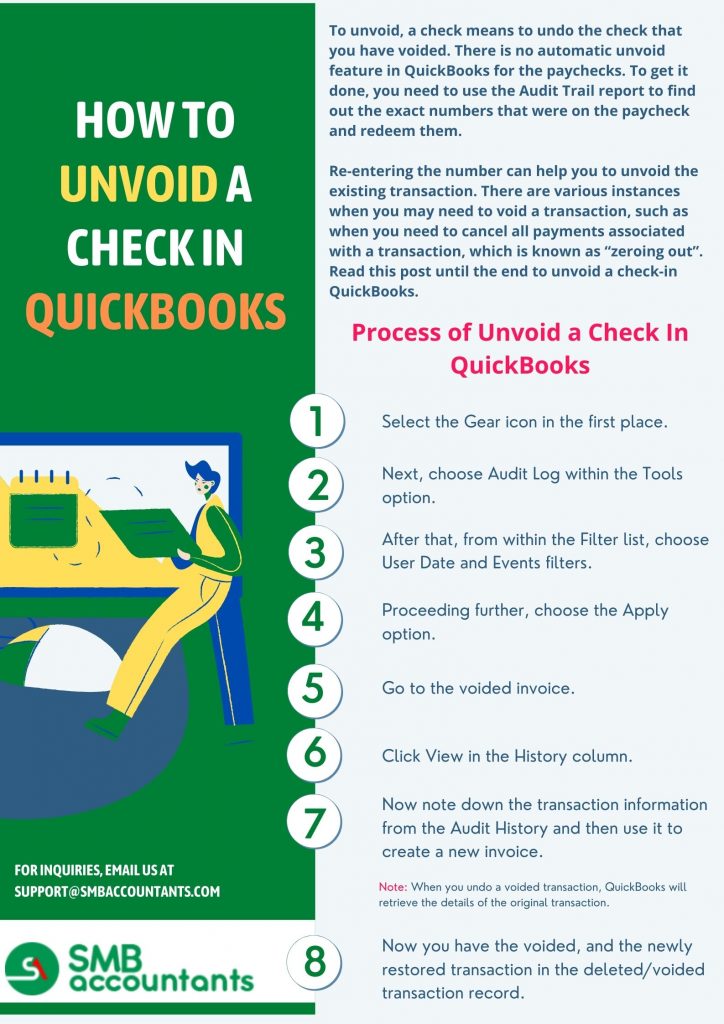

- First of all, go to the Gear icon in your QuickBooks Desktop account

- From the drop-down menu, select the Audit log option that is under the Tools

- Then from the Filters option, choose the User Date and Events Filters

- Select the Apply button

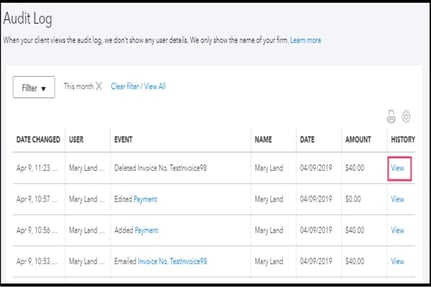

- Search for the voided invoice

- Then in the History column, click on the button View

- Create the new invoice and when you are done then you have to use the information mentioned in the Audit History

- Now you are done.

Read Also: How to Delete Multiple Transactions in QuickBooks

In order to guarantee that the changed check status is implemented permanently in QuickBooks Desktop's accounting records, this last step is essential. By saving the particular changes, you strengthen the adjustments done, upholding precise financial documentation.

In order to ensure that the right information is recorded in the system and to address any disparities in the financial records, the voided check reversal is crucial. By finishing this step, you ensure that all required adjustments are recorded and kept in QuickBooks Desktop, effectively closing the loop on the modification process.

How to Unvoid a Check in QuickBooks Online?

Unvoiding a check in QuickBooks Online includes certain steps that focus on reversing a void check, and making sure precise and updated financial records are in the online accounting software.

This procedure is necessary to guarantee that your accounting records appropriately reflect the transactions that occur in your firm and to preserve the integrity of your financial data. Users must go to the Banking tab, choose Deposit, pick the deposit, and then press More to see the Void option in order to unvoid a check. Users can proceed to unvoid the check by clicking More once again and selecting Unvoid after selecting Void.

Unvoiding of checks in a systematic manner makes sure that your financial reports along with the General Ledger stay accurate, offering a detailed picture of the financial position of your business.

1. Navigate to the Transactions menu and choose Registers

To begin the unvoiding procedure in QuickBooks Online, go to the Transactions menu and choose Registers to view the particular check entry that needs to be reversed using the check management features of the accounting software.

Find the voided check while you're in the register, then press to open the entry. After that, select Edit to make the required changes. Type the accurate check details, including the date, amount, and payee, along with any other relevant data. Before saving the changes, make sure the changes are accurate by double-checking them. This procedure offers a complete solution within QuickBooks Online by successfully reversing the check's voided status.

2. Find the Voided check

Once within the transaction registers, find the particular voided check entry that needs to be reversed. This will guarantee that you precisely identify the desired transaction inside the accounting systems of QuickBooks Online.

To do this, go to QuickBooks Online's Banking page and choose Register to gain access to the transaction registers. Use the search and filter features thereafter to identify the voided check item. After the voided check has been located, take the appropriate action to reverse it and make sure the accounting systems appropriately show the transaction.

The check management tools in QuickBooks Online make it easy to handle voided checks and keep correct accounting records.

3. Press on the Voided check to open it

When you find the voided check, click on it to view the transaction details. This will allow you to make the appropriate adjustments and reverse the process using QuickBooks Online's check management features.

This crucial step guarantees that all transactions that are canceled are handled appropriately and recorded in the accounting system. Users can check the original information, such as the payee, amount, and memo, by opening the voided check and looking for any possible mistakes or irregularities. This procedure guarantees correct financial reporting and reconciliation by enabling the smooth reversal of the canceled transaction if necessary.

Using QuickBooks Online's check management features and understanding the consequences of voiding transactions are crucial for keeping accurate and trustworthy financial records.

4. Press on the Edit menu and choose Void Check

Go to the transaction details, click the Edit menu, and choose Void Check to begin changing the check's status so that QuickBooks Online's accounting services can reverse it.

By voiding a check, you can effectively reverse the transaction and make sure that the system has taken into account the changes. You can enter the cause for the voiding and verify the procedure after choosing the Void Check option. The canceled check reversal procedure is streamlined by QuickBooks Online, guaranteeing accurate and effective accounting records. To make sure the voided check is accurately represented in the accounting system, be careful to analyze the relevant transactions and reports.

5. Edit the status to Unvoid from Void

After the modification of the void check, move to change its status to Unvoid from Void to successfully reverse the termination and reestablish the active state of the check in QuickBooks Online, making sure of precise financial management records.

This step is important since it not only marks the particular check active again, but, it also impacts the financial reporting and records. By unvoiding the check, you make sure the actual transactions remain together, upholding the financial data integrity. It is important for precise financial analysis and bookkeeping.

Reversing a voided check shows the right financial standing of your particular business and saves it from any inconsistencies in financial reporting and reconciliations.

6. Save the Changes

After changing the status of the check, make sure to save the modifications in order to verify the unvoiding procedure. This will verify that the previously voided check was correctly reversed within QuickBooks Online, fixing any previous problems or mistakes.

This last phase is very important since it completes the process and makes sure that the system reflects the changes that have been made correctly. You ensure that the voided check has been effectively reversed by preserving the updated check status, avoiding any possible inconsistencies in your financial records.

It's an essential step in preserving the quality and integrity of your accounting data in QuickBooks Online, providing a dependable means of fixing any mistakes made accidentally and guaranteeing the consistency of your financial records.

How to Import Excel Journal Entries into QuickBooks? [Solved]

How to Avoid the Need to Unvoid a check in QuickBooks?

Assuring correctness and accuracy in financial transactions and accounting administration requires following specific active practices and measures, which in turn reduces the need for unvoiding checks in QuickBooks.

To avoid mistakes that could result in invalidated checks, this involves methodically recording transactions and verifying the facts twice. In order to find and address any differences as soon as possible, it might also be helpful to routinely reconcile accounts and analyze financial records. Reconciliation tools and bank feeds are two QuickBooks features that can help accelerate the process and reduce errors.

Effective communication and teamwork among financial management team members can guarantee complete supervision and minimize the necessity of voiding checks.

All Information Should be Double-Checked Prior to Voiding a Check

Before you void a check, it is important that you review carefully and double-check all the important information to lessen the possibility of issues or inconsistencies, making sure of effective financial management in QuickBooks.

By carefully reviewing transactions, unexpected outcomes like incorrect record-keeping or misreported financial data can be avoided. A greater knowledge of the organization's financial situation is ultimately facilitated by its assistance in protecting the integrity of the financial system and guaranteeing accurate reporting.

By paying attention to such important details, businesses can skip potential inconsistencies and uphold the total correctness and dependability of the financial records in QuickBooks.

Access the Delete Function rather than Void when suitable

When appropriate, think about using the QuickBooks Delete feature instead of Void for particular transactions. This will help you keep more organized financial records in the accounting program and avoid the need for later unvoiding.

As voiding transactions may complicate reconciliations and reporting, this method guarantees that the financial data stays accurate and consistent. Users can acquire a clear, trustworthy transaction history and prevent possible confusion in the audit trail by carefully using the Delete option.

This approach has important consequences, especially for companies that depend on accurate financial data for compliance and decision-making. It also emphasizes how crucial it is to understand the different aspects of accounting software and financial software in order to maximize its functioning.

Maintain Precise Records of Voided Checks

To streamline the process of reversing canceled checks and improve overall financial and payroll administration, keep thorough and accurate records of all voided checks within QuickBooks. This will ensure in-depth documentation and audit trails.

In addition to guaranteeing accountability and openness in financial transactions, this careful record-keeping is essential to upholding regulatory compliance. Businesses can improve their financial operations and efficiently trace any anomalies or irregularities by precisely documenting canceled checks.

Businesses can give stakeholders accurate and reliable financial reporting and build confidence in their financial management procedures by keeping detailed records of canceled checks in QuickBooks.

How to Find Voided Transactions in QuickBooks?

- To see the voided transactions, open the QuickBooks.

- Then go to the Gear-like icon then click on it.

- Under the Tools heading, click on the Audit Log option.

- Now apply the filters so that you can see the specific information that is required.

- Click on the Apply button and then you get the list of the required information.

Infographics to Unvoid A Check in QuickBooks

Final Words

We hope that after reading this entire article, all your queries regarding how to unvoid a check in QuickBooks are clear. In this article, we have highlighted all the key points related to the topic, like what unvoiding a check is, the important steps needed to implement to unvoid a check, etc.

Still, for those of you who are new to this accounting software or lack the technical expertise to deal with technical issues, it is highly recommended to get in touch with our team of QuickBooks experts.

Frequently Asked Questions (FAQ's)

Why it is important to void a check properly?

Incorrect checks can expose businesses to check fraud, which is why it's critical to properly void a check instead of just deleting it. Once the transaction has been void in QuickBooks, the paper check should be safely filed or destroyed.

Can Voiding a Check in QuickBooks be undone?

Voided checks can be easily reverted or undone to the original transaction. Once you delete a check then all the information related to checks will be deleted from the register as well. If there is no record or information of the check was created then the process cannot be undone except in the audit trail.

Can you Unvoid a Payment in QuickBooks?

Yes, When you void a check in QuickBooks, you assign a value of zero to the check, but the check itself remains in the system. Consequently, it is still possible to modify the check and input a new value.

Can I Unvoid a Transaction in QuickBooks?

There is no automatic way to reinstate a voided transaction. However, you can open and view most of the information for the transaction, and then just re-enter the transaction manually.

What is the Journal Entry for a voided payroll check?

Delete the voided check from the list of pending checks if a voided check was written in a previous month and write a journal entry to debit Cash and credit the account that was debited when the check was originally recorded.

Is it possible to unvoid a voided check?

There is an audit process that lets you edit the transaction information. You can use this to reverse a check that was unintentionally canceled.

Is there a way to Unvoid an Invoice in QBO?

Currently, there isn’t an option to unvoid a transaction in QBO. When an invoice has been voided once then it can only be recorded back by creating it once again.

What are the steps you need to implement prior to unvoiding a check in QuickBooks?

To recover the information from any transaction in QuickBooks Desktop prior to unvoiding a paycheck, you need to implement the steps given below:

- Open your QuickBooks Desktop. Now look for the transactions to open them.

- Press on the More option, present at the bottom of the bar.

- Next, press on the Audit History option.

- Now, on the top right side of the window, choose the Show All option. These are edits needed and the actual description of the transaction

Will unvoiding a check in QuickBooks affect my accounting records?

Yes, unvoiding a check in QuickBooks will affect your accounting records, as it involves deleting a transaction from the register and re-entering it. It is important to ensure that you have accurate records before unvoiding a check to avoid any discrepancies.

Can you Unvoid a QuickBooks Invoice?

If an invoice is voided, you will need to recreate it to proceed with recording it again. The Audit Log feature can be used to retrieve the precise information that was included on the invoice.

Can you Delete a Voided Check in QuickBooks?

When you void a transaction in QuickBooks, it sets the transaction amount to zero but retains a record of it in QuickBooks. On the other hand, deleting a transaction completely removes it from QuickBooks. Additionally, deleting a transaction will revert any associated bills to an unpaid status.