Taxes are the most important parts that you need to take care of when you are trying to run a business. Oftentimes, when you are not able to calculate payroll taxes, it halts your business activities altogether. You will have to resolve this issue to be able to proceed with any other important activity.

So when your QuickBooks is Not Calculating Taxes because of some issue, it’s time you look for help. The SMBaccountants help team is here to resolve this issue for you instantly. Follow the procedure carefully. If you face a problem, you can always contact our QuickBooks Desktop Support Team.

What Creates Payroll Tax Errors?

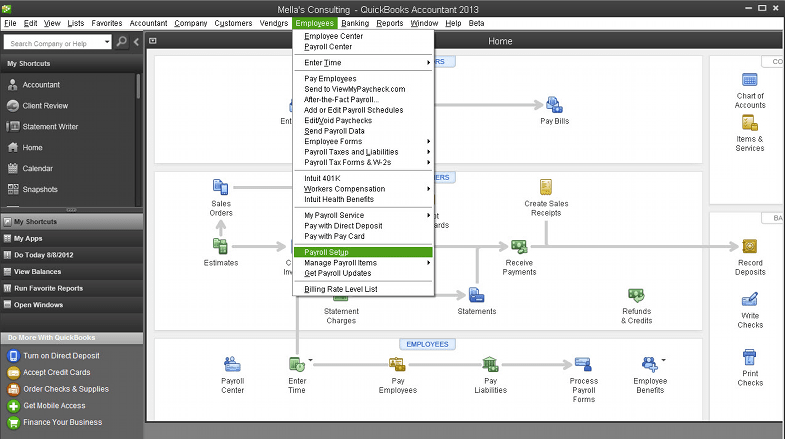

Sometimes when QuickBooks updates a payroll tax table, a payroll process could get stuck when the payroll update is not completely installed. It happens when you start a payroll process, leave the payroll center, and then return after a while.

What Happens?

Let’s say you created payrolls for two different Employees. While the first employee’s payroll consists of taxes you entered, the second employee’s taxes don’t show up on its invoice. This could be a daunting problem if there is more than one employee whose taxes don’t show up or partially show up.

Symptoms of ‘QuickBooks Unable to Calculate Payroll Taxes’ Problem

The QuickBooks payroll error gives distinct indications that it is approaching. These are listed as follows:

- The calculated sum is incorrect.

- Tax-related components are invisible on the paycheck.

- The total sum appearing zero.

What Is The Reason QuickBooks Payroll Isn't Taking Taxes Out Of Payroll Checks Error?

You may find yourself in this situation for many reasons. These include the following:

- A primary reason could be too low gross wages belonging to the employee on the last payroll.

- Payroll tax tables that are outdated can also cause this problem.

- It is also possible to run into this problem if the employee's total salary exceeds the salary limit.

- A payroll tax table that is outdated can also contribute to this problem.

Resolving the Payroll Tax Calculation Error

- You need to save your first customer’s (The one whose taxes are showing up in the invoices), payroll the way it is.

- Go to the payroll of your second customer, and reduce the work hours to One (1 hour).

- Now, let QuickBooks compute it and then save it.

- In case these are the only two employees then you should have no problem. Go ahead and do the same with all the others who are not showing the taxes.

- You should finish the payroll normally, just that you would not be printing the actual paychecks.

- Now, go to the check register and Void the paycheck of the second employee.

- Exit QuickBooks and open it again now. At times payroll isn’t completely installed if don’t restart QuickBooks.

- Head back to the payroll center and create a new paycheck for the second employee.

- Ensure that you have entered the correct starting, ending, and check payment dates.

- QuickBooks will take into consideration the appropriate tax withholding and employer matching amounts while computing the second employee’s paycheck.

- You should see that the second employee’s check is completely right.

- Now, go and try the same method with all the other employees that are having the same problem.

- Ensure that errors in all the paychecks are resolved by now.

Solutions For QuickBooks Payroll Aren’t Calculating Payroll Taxes Problem

Getting rid of payroll tax errors in QuickBooks is quite straightforward since they have a set of solutions that you can implement to resolve the issue.

Solution 1: If the employee's wage or tax information for the year-to-date or quarter-to-date is incorrect

An employee withholding report shows the taxes withheld by all active employees. The process is as follows:

- Initially choose Reports.

- Head to the Employees and payroll.

- Hit a click on Employee withholding.

- Tap on the Customize Report tab.

- Choose the columns as per your requirements.

- Hit a click on the items you want to display on your report in the display list section.

- Choose the OK tab to Save changes.

- Ascertain if your Employees are set up accurately for state, local, and federal taxes.

- For editing the employee info window, ensure to double-click the Employee’s name.

- Moreover, the employee information window will appear on the screen.

- Hit a click on Payroll info.

- Tap on the Taxes tab.

- Hit a click on Federal, state, and/ or other tab.

- Ensure that the employee is marked correctly for taxes.

Solution 2: Payroll Subscriptions Purchased Through QuickBooks

- This scenario allows you to save the employee's paycheck based on the calculations you made earlier.

- Ensure accurate calculations by changing the employee's check details.

- Ensure that both the Withholding and Employer matches are entered manually in QuickBooks payroll.

- In case you have already subscribed to the assisted payroll version, you may encounter problems with Intuit filling out the payroll taxes.

- Make sure QuickBooks is updated to the latest version to get rid of the error.

- The software will be updated with the latest payroll forms and tax tables as a result.

- Make sure that the Employees and Payroll items are set up correctly before running payroll.

- It is possible to experience this issue if the QuickBooks data isn't set up properly.

- There is a possibility of experiencing this issue if the data within the QuickBooks software is not set up properly.

Solution 3: Check if the Annual Limit has been set or Reached

You can verify the setup of the item by If a payroll item is not calculating correctly and stops calculating on a paycheck, there may be a checkmark in the checkbox of an annual limit box and default limit which the employee has exceeded.

- Select Lists and Payroll Item List from the top menu bar.

- Right-click on the payroll item you wish to modify and select Edit Payroll Items.

- Scroll down until you reach the Limit Type screen on the Next screen.

- Now verify that the box at the bottom is correct

- An employee's payroll should stop calculating this limit if the limit is correct.

- The limit should be updated if it is incorrect.

- Next is to do is under Limit Type, Verify that you have chosen the right option.

- Annual – Restart every year

- Monthly – Restart every month

- One-time limit

- The default limit or Limit Type can be changed to suit your needs.

- Click Finish to complete the process.